AI Based KYC Verification

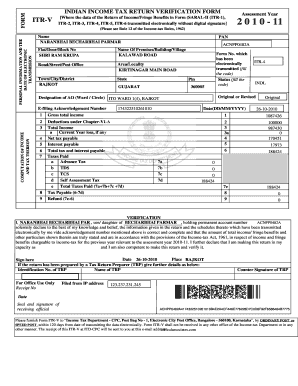

Income Tax Return copy Analysis

Generally while applying for Borrower submits self attested photo copies of Income tax return copy ( ITR 2, ITR4 etc ) and profit and loss account though for revalidation ( Fraud Check ) bankers needs to submit photo copies of ITR/Profit and loss account to Third party agency and then third party agency visits Income tax office at their convenience and physically cross check about the correctness of these documents, which is time consuming process with manual intervention and there is a chances of human error or not getting required and correct information. Off course it comes with heavy cost with payment to third party services.

Solution:

ITR analysis is API based service wherein Bank needs PAN number and Aadhar linked contact number of borrower, by putting PAN and Aadhar linked mobile number on API, Post OTP based authentication/confirmation from borrower , banker can get correct information online for checking ITR authenticity. This is OTP prompted Verification API.

Voter ID Verification

In current scenario specially in Micro banking and finance , borrower comes in bank with his original Aadhar card and self attest the Aadhar Card copies though originality of Aadhar card with picture based verification is not possible from other sources.

Solution:

In AI based solution, Banker can input only Aadhar number on given system, banker will get genuineness results which can be cross verified with other KYC documents.

Driving license Verification

Sometimes Old Driving license gets damaged or details noted on the same feds away, with Driving license number, we can cross check the document through online API.

Solution:

Banker can login in the system and put the Driving license number on the given field, all Driving license related details will come on output report for cross verification.

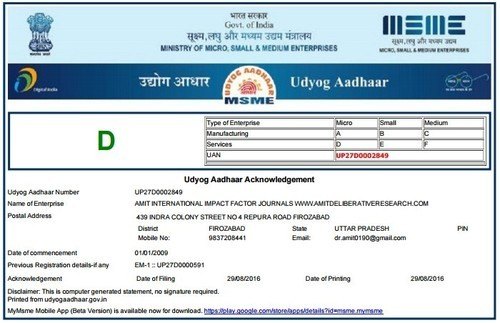

Udyog Adhar Verification

Udyog Aadhar is issued to borrowers with national identity of Business, this will provide details of company’s main nature of business, it is a self certified copy which borrower submits to bank with no source to cross verify the same.

Solution:

Banker can verify its correct data by using Udyog Aadhar Registration number on given portal. All business related data points can be verified through portal.

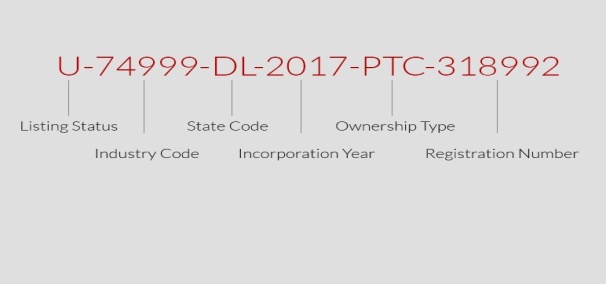

CIN Verification

We can verify CIN number of Private Limited Company as well as of LLP.

Following details can be checked from this API

- Name of Private Limited Company

- Address of Borrower

- Date of incorporation

- Correct CIN of Company.

Passport Verification

Sometimes fake passport details are submitted to banks / NBFCs for the credit proposals or approvals, it is difficult to verify its authenticity.

Following details can be checked from this API

- Name of Passport Holder

- Passport Holders father, mother and wife’s name

- Passport Number

- Residential address noted at the time of passport issuance

- Date of Birth

- Place of Birth

- Date of Issuance and expiry

TAN Verification

TAN number can by verified from API by putting up Company name on API.

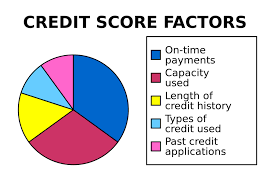

Credit Score Check ( CRIF )

CRIF is one of the RBI suggested tool to verify credit history of the borrower or loan applicant. Through this API bank/NBFC van verify borrowers credit history, his past borrowings, its repayment track, delays if any and default made by the borrower in the past.

CIRF is same like CIBIL or any other Credit history report.

PAN verification

Through this API , we can verify correctness of PAN holder.

- PAN number

- Name of Pan holder

- Date of Birth

Aadhar Verification API

Through this API , we can verify Aadhar details by putting up Aadhar number on API which is further prompted by OTP from the Aadhar card holder. You can verify all correct information noted on Aadhar Card and can cross verify with copies submitted by Aadhar card hodler ( if any ).

You will get following information on API.

- Name of Aadhar Card holder

- Age

- Residential Address

- Aadhar Number

Bank account Verification

Traditional way of Term Loan Disbursement.

- Post sanction borrower provides Purchase Order (PO) and bank details of supplier of machine/material/contractor/supplier.

- Disbursement Department / Branch inputs suppliers bank details in NEFT/RTGS payment gateway and sends money or issue Pay order/DD in favor of supplier.

- Due to human error sometimes money goes to wrong account or amount gets returned back due to wrong Account details provided by the borrower.

Solution:

- Though Bank account verification API, banker can put only Account number and IFSC code in the system as a result API will show us all account related details like name of account holders, account number, bank name, bank branch , branch location, IFSC code.

- For above verification banker need to disburse 1 rupee into that account.

- Bank/NBFCs have to have bank account with following banks to avail the benefit of this solution. HDFC Bank / ICICI Bank / Indusind Bank / Yes Bank

GST number verification

Currently borrower submits Vendor/suppliers invoices for discounting or for term loan disbursement to banks/finance company’s though there is no check on correctness/genuineness of the submitted invoice.

Solution:

- Before release of disbursement/payment can verify the genuineness of the invoice submitted by the borrower or client.

- Bank can cross verify following details from GST number. Name of supplier, Address of supplier, GST number of supplier, Details of Partners/directors etc