MFIs

Microfinance has been touted as an instrument that can raise the incomes of those living below the poverty line.

A business based on the concept of doing well by doing good. MFI clients comprised primarily of low-income women who take loans to support tiny enterprises like neighbourhood shops, poultry farms, etc. The loans MFI clients seek are small – typically 10000 to 25000 – and the bank requires no collateral. It is a version of “microfinance”, the idea associated with Muhammad Yunus and Grameen Bank of Bangladesh, winners of the 2006 Nobel Peace Prize. For Yunus, microfinance can unleash the productivity of cash-starved entrepreneurs and raise their incomes above poverty lines.

At MFIs , quantum of advances are very low, so the faster and quick disbursement are the essence of the business. Majority advances are done based on verification of borrowers KYCs physically by local officers.

We at Fundupay can serve MFIs by offering quickest services for verifications of varied types of KYCs.

Fundupay can offer following services to MFIs.

- Cloud data storage

- Buy now Pay later Product

- Payment platform

- AI based KYC verification

We are noting here specific AI based KYC verification for MFIs which are as follows.

Voter ID Verification

In current scenario specially in Micro banking and finance , borrower comes in bank with his original Aadhar card and self attest the Aadhar Card copies though originality of Aadhar card with picture based verification is not possible from other sources.

Solution:

In AI based solution, Banker can input only Aadhar number on given system, banker will get genuineness results which can be cross verified with other KYC documents.

Driving license Verification

Sometimes Old Driving license gets damaged or details noted on the same feds away, with Driving license number, we can cross check the document through online API.

Solution:

Banker can login in the system and put the Driving license number on the given field, all Driving license related details will come on output report for cross verification.

Udyog Adhar Verification

Udyog Aadhar is issued to borrowers with national identity of Business, this will provide details of company’s main nature of business, it is a self certified copy which borrower submits to bank with no source to cross verify the same.

Solution:

Banker can verify its correct data by using Udyog Aadhar Registration number on given portal. All business related data points can be verified through portal.

Aadhar Verification API

Through this API , we can verify Aadhar details by putting up Aadhar number on API which is further prompted by OTP from the Aadhar card holder. You can verify all correct information noted on Aadhar Card and can cross verify with copies submitted by Aadhar card hodler ( if any ).

You will get following information on API.

- Name of Aadhar Card holder

- Age

- Residential Address

- Aadhar Number

Bank account Verification

Traditional way of Term Loan Disbursement.

- Post sanction borrower provides Purchase Order (PO) and bank details of supplier of machine/material/contractor/supplier.

- Disbursement Department / Branch inputs suppliers bank details in NEFT/RTGS payment gateway and sends money or issue Pay order/DD in favor of supplier.

- Due to human error sometimes money goes to wrong account or amount gets returned back due to wrong Account details provided by the borrower.

Solution:

- Though Bank account verification API, banker can put only Account number and IFSC code in the system as a result API will show us all account related details like name of account holders, account number, bank name, bank branch , branch location, IFSC code.

- For above verification banker need to disburse 1 rupee into that account.

- Bank/NBFCs have to have bank account with following banks to avail the benefit of this solution. HDFC Bank / ICICI Bank / Indusind Bank / Yes Bank

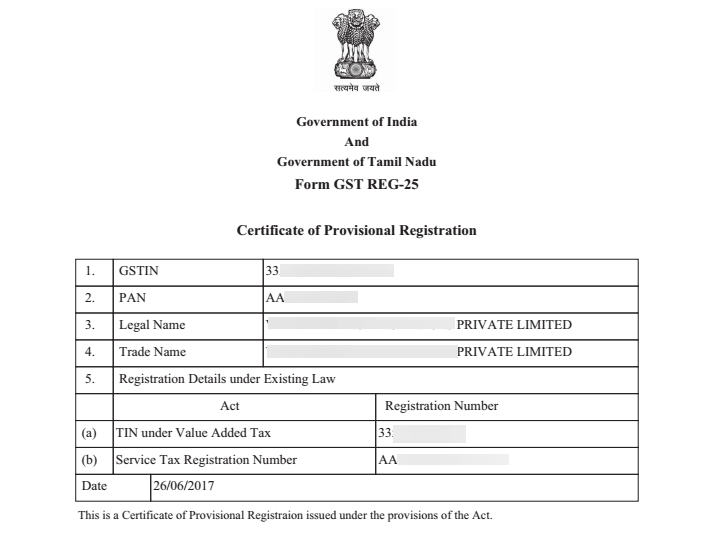

GST number verification

Currently borrower submits Vendor/suppliers invoices for discounting or for term loan disbursement to banks/finance company’s though there is no check on correctness/genuineness of the submitted invoice.

Solution:

- Before release of disbursement/payment can verify the genuineness of the invoice submitted by the borrower or client.

- Bank can cross verify following details from GST number. Name of supplier, Address of supplier, GST number of supplier, Details of Partners/directors etc