Bank Statement Analysis

Feature of traditional bank statement and its assessment.

- Usually clients (borrower of Home loan, Car loan, Working capital, Term Loan etc ) are normally submits the physical bank statements running into numbers of pages.

- Bank statement comes with bunch of papers which increases the weight of proposal file.

- Bank need to dedicate one special senior officer for going through the statements and he needs to check following points.

- Start date of statement, no missing pages, dates of statement, last date of statement, month wise break up of statement, total month wise debits and credit, unusual transactions, inward cheque bounces/outward cheque bounces, salary identifications, monthly loan installment identifications, important transaction wise narrations, genuineness of bank statement, preparation of excel sheet, consolidating yearly debit and credits etc….

- Multiple banks statement will make more mess while working on multiple statements.

- Difficult to manage physical bunch of papers.

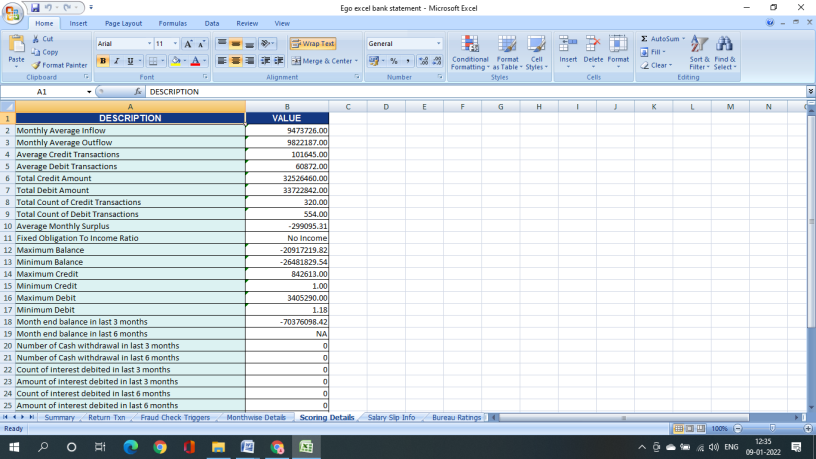

With FundUPay’s Bank statement analysis, a clear PDF form of bank statement pages can be converted into excel based analysis with credit points captured into it.

Majorly Risk points can be seen in output file which is helpful in credit decision making for bank officer or Risk Officer.